-

SSC Public Exams results on April 30

-

Biden set to sign ‘historic’ bill, threatening nationwide TikTok ban

-

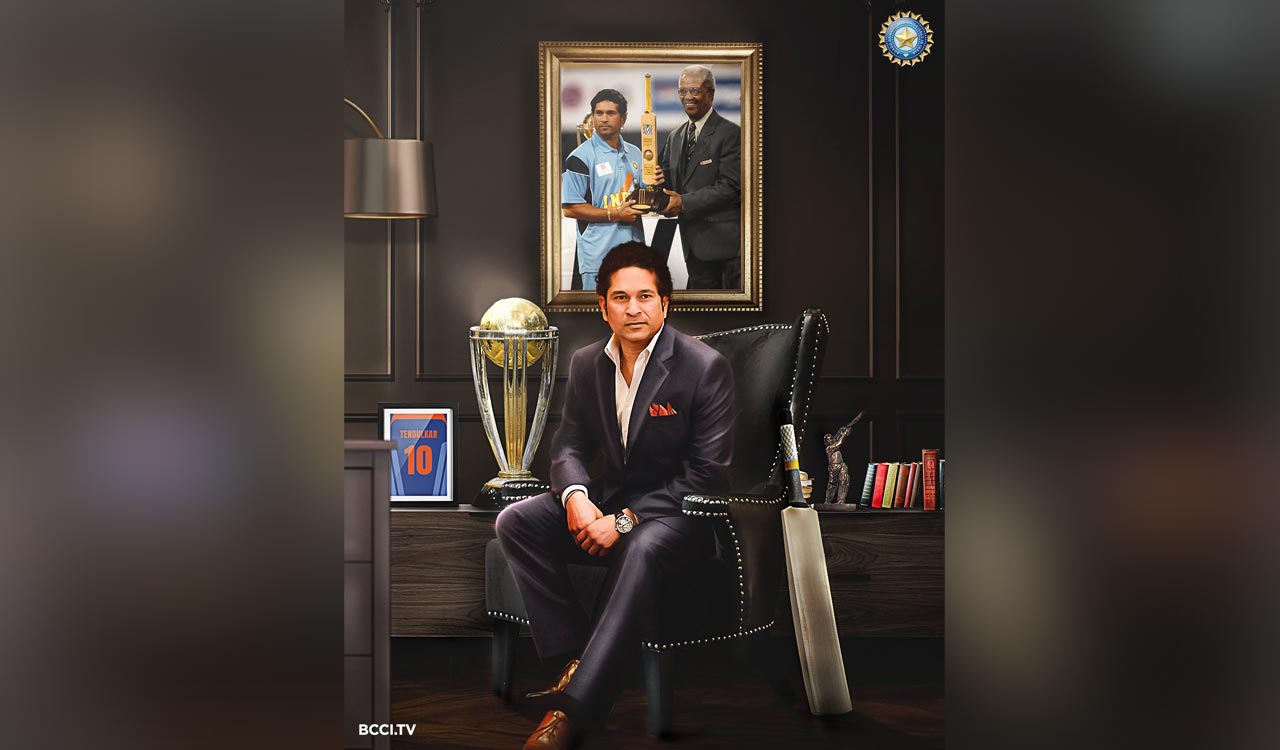

Sachin Tendulkar’s ICC Triumphs: A glance at master blaster’s legacy on 51st birthday

-

DRDO creates India’s lightest level 6 bulletproof jacket

-

IPL 2024: DC v GT on April 24; When and where to watch

-

Nothing to do with phone tapping; controversy is cheap politics, says KCR

-

Revanth Reddy nursing cash-for-vote grudge, says KCR

-

No one can wipe out KCR from TS history, says BRS chief

-

Workshop on Forest Act organised for forest officers

9 mins ago -

Beating the heat in style,Hyderabadi way

11 mins ago -

Minister Komatireddy Venkat Reddy offers to quit

18 mins ago -

Farmers ready to revolt against Congress government: KTR

22 mins ago -

Four Congress leaders file nomination for Khammam LS

28 mins ago

-

Sharp rise in malpractice cases during Intermediate examinations

-

Traffic advisory issued for Mehdipatnam-Aramgarh road users on Thursday in view of CM’s roadshow

-

Hyderabad: Teenager dies in road accident at Jubilee Hills

-

ISTA Centenary meet at Cambridge from July 1-4

-

CriticalRiver announces 100 pc ownership for all its employees through ESOP initiative

-

City surgeons conduct a surgery on one year old using Indian robotic system

-

Congress certain to make a comeback in Delhi, says Revanth Reddy

-

Now learn Urdu – the language of poets and dreamers

-

Hyderabad: 80 forest officers undergo training to address wildlife crimes

-

Cyberabad SOT conducts rains on belt shops, liquor worth Rs. 2 lakh seized

-

KLH Hyderabad with Fortinet launches cybersecurity program

-

TSDCA seizes drugs with misleading advertisements

-

Modi’s only guarantee is hatred towards muslims: Owaisi

-

Congress certain to make a comeback in Delhi, says Revanth Reddy

3 hours ago -

At Bihar rally, Owaisi questions silence of Nitish over Modi’s remarks

4 hours ago

-

Destination USA: Student life in the U.S.

3 weeks ago -

British Council announces GREAT Scholarships 2024; more details here

2 months ago -

TS EdCET to be held on May 23

2 months ago

-

Minister Komatireddy Venkat Reddy offers to quit

-

Farmers ready to revolt against Congress government: KTR

-

Four Congress leaders file nomination for Khammam LS

-

Sharp rise in malpractice cases during Intermediate examinations

-

KCR vows to fight on behalf of distraught farmers, ensure them justice

-

Editorial: Campaign hits a new low

22 hours ago -

Editorial: Boost to defence exports

2 days ago -

Editorial: Maryam’s olive branch

2 days ago -

Editorial: Israel-Iran conflict deepens

5 days ago

-

IPL 2024: DC v GT on April 24; When and where to watch

-

Avanthi college clinch Taekwondo championship

-

Arul wins Brilliant Trophy Open Online Chess Tournament

-

Krishav records win in Vemuri Sudhakar Memorial Open Badminton Tournament

-

Sanju Samson should be groomed as next T20 captain for India after Rohit, says Harbhajan Singh

-

TDP to repeal Andhra Pradesh Land Titling Act if voted to power: Chandrababu Naidu

11 hours ago -

Andhra CM Jagan engages with YSRCP social media influencers in Visakhapatnam

11 hours ago -

KRMB stops NSP water releases to AP

1 day ago -

AP medical student dies in Kyrgyzstan

1 day ago -

Andhra Pradesh polls: With Rs 5785 cr assets, TDP LS contestant Chandra Sekhar stirs poll attention

1 day ago -

Andhra Pradesh Board SSC Result: 86.69 pc students pass, girls outshine boys

2 days ago -

Two Telugu students drown at tourist spot in Scotland

2 days ago

-

‘Love Me – If You Dare’ set to hit theatres on May 25

-

Vijay Deverakonda, Mrunal Thakur’s ‘The Family Star’ to make OTT debut on this date

-

Kareena Kapoor’s Tanzanian holiday snaps with Taimur

-

Aamir Khan explains to Kapil Sharma why he doesn’t attend award shows: Time’s precious

-

Preity Zinta returns to bollywood in ‘Lahore 1947’ with Sunny Deol

-

Game On: Playing through the heat

-

Samsung unveils Galaxy M55 5G, Galaxy M15 5G

-

Samsung launches Galaxy A55 5G, Galaxy A35 5G in Hyderabad

-

Is India part of Apple’s Vision Pro global roll out plan? Find out

-

All you need to know about Indian Govt’s ‘Major Security Alert’ for Google Chrome users

-

Opinion: Anxiety over job loss

22 hours ago -

Opinion: Banning plastic only solution

2 days ago -

Opinion: Mentoring in the age of AI

2 days ago -

Opinion: Rupee as reliable currency

5 days ago -

Why West Asia matters

6 days ago -

Resilience amidst deluge

6 days ago -

Opinion: Replacing the dollar

7 days ago

-

mRNA vaccine tech can be harnessed to prevent deadly diseases: Report

-

Biden set to sign ‘historic’ bill, threatening nationwide TikTok ban

-

Elon Musk’s X challenges YouTube with TV app launch

-

Elon Musk calls for Tesla restructuring amid slow growth

-

DRDO creates India’s lightest level 6 bulletproof jacket

-

Indonesia officially declares Prabowo Subianto as President

7 hours ago -

Family of man allegedly died by CM Maryam’s motorcade receives PKR 2.5 mn compensation

8 hours ago -

Biden set to sign ‘historic’ bill, threatening nationwide TikTok ban

9 hours ago -

Russia vows increased strikes on Western Arms in Ukraine

12 hours ago