Opinion: Ed-techs await a new dawn

By Amit Mishra Startups in online education saw a spike as a result of the ‘stay-at-home’ Covid policy. Now, as India gets back to the ground, a large number of ed-tech employees are going home. A stock market meltdown earlier this month did not bode well for the wider economic world, and as a result, […]

By Amit Mishra

Startups in online education saw a spike as a result of the ‘stay-at-home’ Covid policy. Now, as India gets back to the ground, a large number of ed-tech employees are going home.

A stock market meltdown earlier this month did not bode well for the wider economic world, and as a result, startup financing has slowed to a trickle. Indian entrepreneurs raised nearly $12 billion in investment in the first quarter of the year, creating 13 new billion-dollar startups in the process.

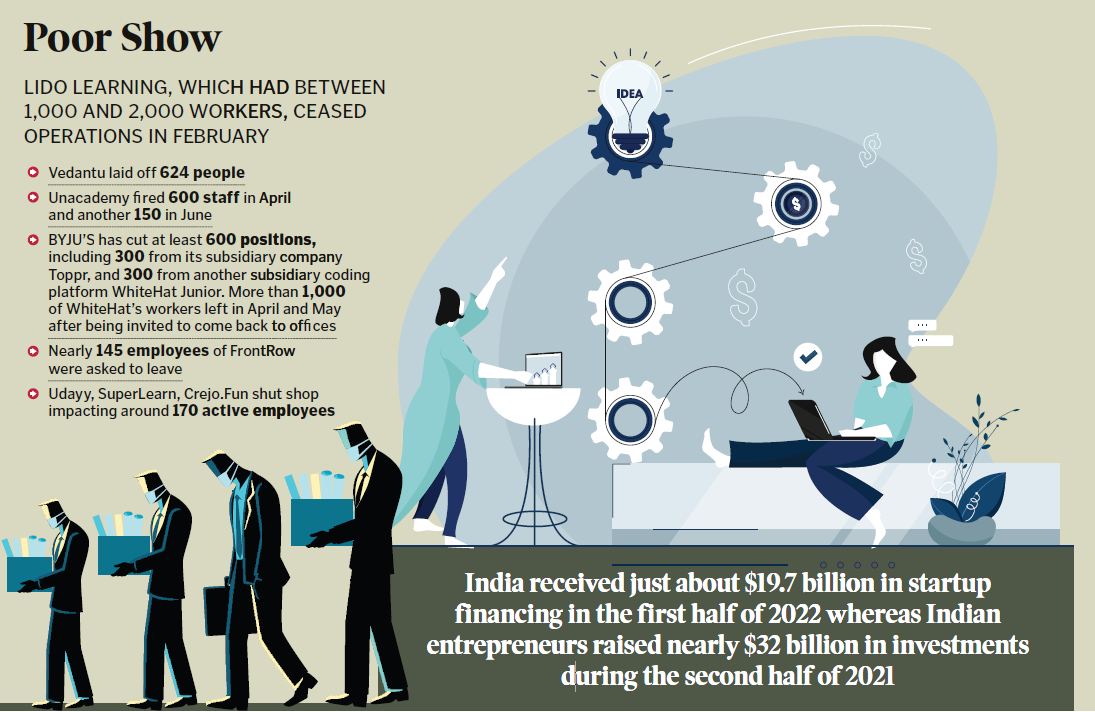

Startup Financing

India received over $19.7 billion in startup financing in the first half of 2022. In contrast, Indian entrepreneurs had raised nearly $32 billion in investments during the second half of 2021, which is about $12 billion more than they did in H1 2022.

The numbers allude to the fact that the acceleration of venture capital investment has taken a hit in the first six months of 2022. Startups are under tremendous pressure as valuations have started to drop and expounding capital has been more challenging than in the past, especially for those who profited during the times of Covid.

Venture-Capital firms like Sequoia and Y Combinator have put the reins on their invested startups by asking them to cut down on expenses and simultaneously advocating to not lose the grip on the rate of scalability. The consequential effect of economising has transmuted into downsizing while keeping the benchmark of survival and profitability fluid.

A once thriving sector, the ed-tech sector has contributed to the creation of more than 75,000 jobs in India over the past five years and has also helped alleviate the employment problem during the Covid-19 crisis. A report by the IEC validates the numbers.

Different Story

Egregiously, things convey a different story now; of the 12,000 employees who were laid off in the last six months, nearly 30% of them came from the ed-tech space, which formed a big chunk of the downsized corpus. This is the reason why of all the sectors, ed-tech has received the most criticism. In addition to having let more than 4,000 human resources go, it also resulted in the closure of three businesses. Startups in the ed-tech sector have borne the brunt of inordinate funding slowdown.

An ed-tech platform named Lido Learning, which had between 1,000 and 2,000 workers, ceased operations in February. 624 people were let go by Vedantu, while 600 employees of Unacademy lost jobs in April. Ed-tech behemoth BYJU’S has cut at least 600 positions, including 300 from its subsidiary company, Toppr, and 300 from another subsidiary coding platform, called WhiteHat Junior. More than 1,000 of WhiteHat’s workers left in April and May after being invited to come back to the offices.

Post the dismissal of over 600 staff earlier this year, Unacademy fired another 150 workers in June. Nearly 145 employees of FrontRow, an ed-tech start-up focusing on the extra-curricular, have been let go as funding becomes scarce due to the market slump. The ed-tech firm Udayy has terminated 100–120 employees and ceased operations after seeing a slowdown in sales as a result of schools being reopened online. Crejo.Fun is the third ed-tech business to cease operations in 2022, after Udayy and SuperLearn, impacting nearly 170 active employees.

The Ordeal

The reopening of schools, colleges, and physical tutoring facilities, along with the worldwide discordant economic conditions, has caused the education technology sector to go through the ordeal. The need for virtual learning and dependence on high-end gadgets laced with expensive educational applications is dwindling as more conventional tuition centres, schools and institutions begin to operate, owing to the relaxation of Covid-19 regulations. The burgeoning ed-tech enterprises in India have been adversely impacted by the sluggish demand and the much-discussed ‘funding winter’.

It seems that the great ed-tech adventure is now marred with volatility. The recent surge in the creation of offline coaching centres by ed-tech giants like BYJU’S, Unacademy, Vedantu and PhysicsWallah indicates that the much-hyped disruption of the education sector, never actually happened.

The thought for contemplation is that, are these ed-tech companies really bringing about the much-awaited change that could make education accessible to all and at cheaper rates, and if not, then all we can do is await the first profitable ed-tech company to emerge out of the coterie. As their sales executives gear up with their sales pitch to call masses on phones awaiting either an incentive or a pink slip, we wait for the break of dawn for the ed-tech industry.

(The author is Academic Associate, Indian School of Business)

Related News

-

AIIMS study finds no link between COVID-19 vaccines and sudden deaths

-

Children of mothers infected with Covid during pregnancy at higher risk of autism, speech delay: Study

-

Editorial: Time to regulate coaching factories

-

Nepal records first covid death in over two years amid omicron sub-variant surge

-

Congress government pushes TDR for land acquisition in Hyderabad

6 mins ago -

Telangana police forfeit Rs 6.88 crore properties in Sangareddy Alprazolam case

14 mins ago -

Hyderabad: Pedestrian fatally struck by RTC bus in Miyapur

16 mins ago -

BVRIT to showcase innovative ATVs at mBaja 2026

16 mins ago -

Aries Agro distributes electronic prosthetic hands to 70 persons with disabilities in Telangana

24 mins ago -

Niranjan Reddy slams Congress over Gandhi statue project in Hyderabad

26 mins ago -

Telangana RTC workers stage peaceful ‘Chalo Secretariat’ protest in Hyderabad

29 mins ago -

MLRIT students win second prize at SAE Drone Development Challenge 2025–26

38 mins ago