Centre puts spoke in Telangana’s borrowings

Hyderabad: The BJP government at the Centre continues to make all attempts to derail the growth of a rapidly progressing Telangana, this time around coming up with fresh restrictions that prevent the State from raising open market borrowings to meet its financial requirements. The Centre is also not responding to repeated requests from the State […]

Published Date - 10 May 2022, 12:36 AM

Hyderabad: The BJP government at the Centre continues to make all attempts to derail the growth of a rapidly progressing Telangana, this time around coming up with fresh restrictions that prevent the State from raising open market borrowings to meet its financial requirements. The Centre is also not responding to repeated requests from the State government to accord necessary approvals to avail loans as provided under the Constitution.

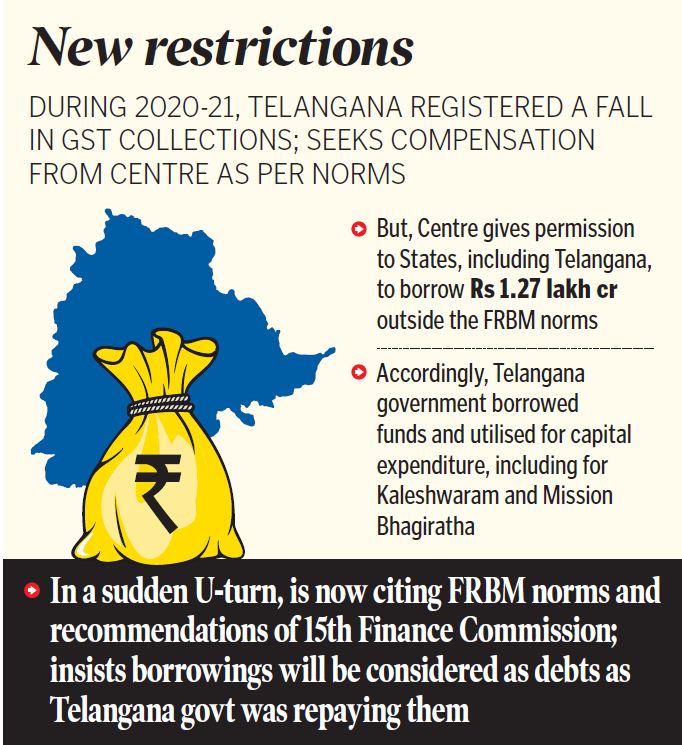

In 2020-21, the State government recorded a drop in GST collections and subsequently, sought compensation from the Centre as per norms. It also insisted that the Centre release pending funds as well as grants as per the recommendations of the 15th Finance Commission.

The union government, in response, asked Telangana to raise borrowings from the open market towards capital expenditure and gave the necessary approvals. The Centre also gave guarantee to the banks for States, including Telangana, to raise a total of Rs 12,000 crore in 2020-21 and Rs 15,000 crore in 2021-22 as market borrowings. It recently approved raising another Rs 1 lakh crore of market borrowings.

The State government raised funds through market borrowings through Kaleshwaram Irrigation Project Corporation Limited, Telangana Drinking Water Supply Corporation Limited and Telangana State Water Resources Infrastructure Development Corporation, among others.

The Centre, which had earlier asked the States to borrow to meet capital expenditure, in a sudden U-turn, is now citing the FRBM norms as well as the recommendations of the 15th Finance Commission. It has been insisting that these borrowings would be considered debts rather than capital expenditure as the Telangana government was repaying them. The Finance Ministry is learnt to have raised questions over the repayment capacity of various corporations through which these borrowings were availed.

At a video conference with Finance Secretary TV Somanathan on Monday, Telangana presented a strong case in support of its request for early permission to raise open market borrowings to meet its immediate financial requirements. Special Chief Secretary for Finance K Ramakrishna Rao informed that the government had used the amounts it raised as capital expenditure effectively for schemes like the Kaleshwaram Lift Irrigation and Mission Bhagiratha which had emerged as models for the country. “All these projects are at various levels of completion. Unless these projects are completed, the corporations concerned will not be in a position to repay these borrowings with a government guarantee,” he pointed out.

Despite the 15th Finance Commission not making any recommendations, the decision of the Centre to consider the ‘Off Budget’ borrowing as State debts should be viewed as nothing but ‘discrimination’ towards the State which was emerging as one of the strongest economies. The 15th Finance Commission, in fact, recommended constitution of an expert group to give suggestions on amendments to the FRBM Act. However, no action has been initiated in this direction till date.

Sources said Ramakrishna Rao raised objections over the Centre asking questions related to market borrowings of the previous years retrospectively. He is learnt to have pointed out that it was the Centre which gave permission to the States to borrow Rs 1.27 lakh crore outside the FRBM norms. The Telangana government utilised the borrowed funds for capital expenditure.

The Finance Secretary is understood to have told the State officials that the Centre had taken note of the issues raised by the State, and reportedly assured them that these would be examined.

Now you can get handpicked stories from Telangana Today on Telegram everyday. Click the link to subscribe.

Click to follow Telangana Today Facebook page and Twitter .