Beast behind beauty

Given the severe impact plastic waste from the cosmetics industry has on our environment, its own eco-friendly makeover is urgent

The beauty and cosmetics industry, which saw a boom with the emergence of Aishwarya Rai and Sushmita Sen on the world stage, is only growing by the year. It is expected to have a market size of $20 billion by 2025, ie, more than twice that of the household care market (eg, detergents, ice-creams).

Unlike some other products (such as drinking water or food packaging), the cosmetics industry has rarely been put on the dock for the plastic waste it generates. According to a few reports, personal care and beauty products make up one-third of the materials found in landfills. Still, the movement from conspicuous to conscious consumption in the cosmetics industry has not taken off.

The major environmental threat comes from the extensive use of non-renewable packaging for the products. The beauty industry creates an estimated 120 billion packaging units per year, which eventually make their way to landfills. The perception with beauty products is that elegant and classy packaging will extend to consumers’ looks as well. Such packaging designs can be achieved at a reasonable cost with plastic. Plastic is lightweight, flexible, and easily moulded to achieve an aesthetic appeal that may not be possible with other packaging materials like glass, paper, cardboard or aluminium. Thus, plastic, just like the product ingredient, becomes a quintessential part of the beauty buyer’s experience.

Going Green

Despite the severe impact that the industry has on the environment, very little is being done by firms to adopt sustainable practices. Similarly, there is little external pressure on this industry. Even though the government has pledged to ban single-use plastics by 2022, the pressure is mostly on Fast Moving Consumer Goods (FMCG) rather than cosmetics companies.

The “green” trend that has garnered much attention in cosmetics is about natural and organic ingredients. The organic cosmetics market is growing at a rate of 25% per year. Not surprisingly, brands are responding to the trend by introducing products with natural ingredients (which are bio-degradable). For instance, HUL has launched a new line of soaps, shampoos, conditioners, and body creams produced with natural ingredients under the brand name ‘Love, Beauty, and Planet’. However, this tactic appears to be merely to achieve a natural/organic positioning in consumers’ minds.

While the push towards natural ingredients is in the right direction, it is insufficient. We need a movement towards using eco-friendly packaging since much of the cosmetics industry’s environmental pollution is from its plastic packaging. A cosmetic brand will be truly eco-friendly when it redesigns its plastic product packaging, uses biodegradable ingredients, and sources/sustainably produce the raw material.

Rating Brands

To understand how brands currently fare, we undertook a scoring exercise rating brands on their sustainability measures such as green packaging, sustainable sourcing, use of biodegradable ingredients, and waste management process. Twenty-seven brands across five product categories (lip balm, body lotion, face wash, hair conditioner, and sunscreen lotion) were studied.

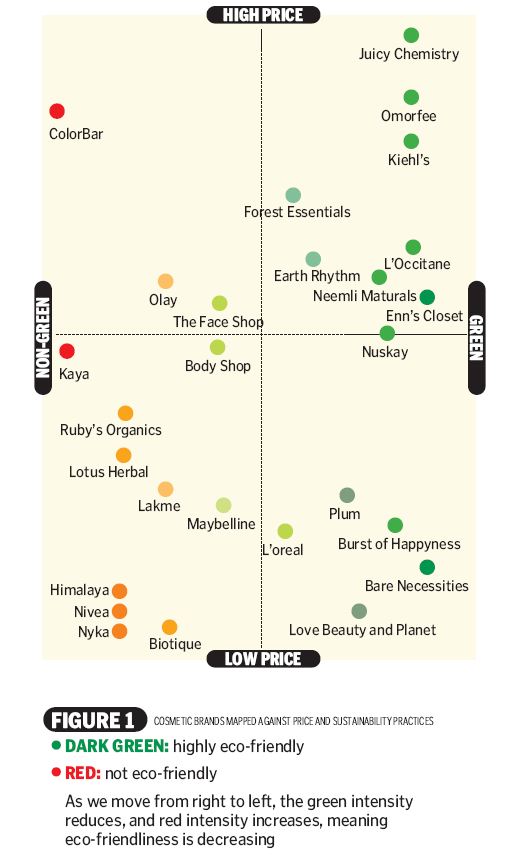

The selected brands offered a diverse range of benefits and had a significant market share. They spanned across all possible product benefits – preference for environmentally friendly products, natural products, luxury products, cheaper products, visually appealing products, cruelty-free/chemical-free products, and clinically suggested products. After scoring brands on sustainability, we mapped them against their prices. Figure 1 demonstrates the output.

We find that the brands scoring high on sustainability practices tend to be more expensive than the non-green products. These brands are mostly positioned as natural or organic brands, while their green packaging benefits are not necessarily highlighted. Interestingly, the expensive products tend to follow some or the other sustainability practice as you will notice there are very few products that are non-green and high-priced. We find that eco-friendly packaging comes at a premium price. While there are some low-priced green products (eg, Bare Necessities, Burst of Happyness), they tend to have a limited range of products for their customers.

It is important to note that the brands with larger market share (eg, Himalaya, Nivea, Lotus, Lakme, etc) have poor sustainability practices. From the analysis, we conclude a market gap of low-priced, green products where firms could enter. Unilever’s ‘Love, Beauty, and Planet’ is a response to this demand and aims to bring sustainability to the masses using its extensive distribution channels.

We tried to understand from experts why there are few firms in the space of green + low-price quadrant. Experts from the cosmetics industry suggested that consumers concerned about “green value” are a small segment; hence firms tend to focus mostly on the product features rather than sustainability. They believe that while large multinationals, like Unilever or L’Oréal, have committed to producing eco-friendly products, they are not promoting them.

Some steps in this direction include Unilever constructing a new production facility to dispose of non-hazardous packaging waste to landfill or Marico making their Parachute oil bottle 7% lighter to reduce plastic packaging consumption. Brands like Aveda and Garnier have increased the use of recycled plastics in their packaging.

Little Awareness

Firms believe that eco-friendly packaging is not a vital feature for cosmetic product buyers. For instance, while customers actively coerce the FMCG industry to adopt sustainable options, these pressure tactics are not seen for cosmetic products. Moreover, consumers are much less likely to recycle cosmetic packaging than food and beverage packaging. The firms, thus, pass the buck to the customers suggesting that customers are not invested or interested in the sustainability practices of cosmetics firms.

We find out whether that is the case by surveying more than a hundred well-educated millennials. We found that around 76% of the respondents have never purchased eco-friendly cosmetic products. This result was surprising since many of the respondents were at least moderately environmental conscious partaking in carrying bags for grocery shopping or composting.

We probed further to understand why this was the case. The low preference for eco-friendly cosmetic products is not only because of low awareness about the existing options but also because of low awareness about the necessity of eco-friendly cosmetic products. These results suggest the urgent need to make the public aware of cosmetics’ damage to the environment.

Millennials Perception

To understand if the customers will buy eco-friendly products if made available, we gave our participants two options to choose from — a regular Pantene and an eco-friendly packaged Pantene. The eco-friendly option was slightly more expensive. We found that many customers were willing to switch to the eco-friendly option even for a premium price. This indicates there is a market opportunity for firms. Or, it could mean that the participants chose the green option since it was socially desirable and not costly to do so.

We also conducted a conjoint analysis where the participants could highlight their most desirable features in a cosmetic product and the trade-off, they were willing to make on various product features. We found a negative connotation attached to plastic packaging. However, the requirement for low-price products overshadows that. Consumers surveyed, that is, well-educated price-sensitive millennials were willing to pay on an average of up to Rs 30 more for an eco-friendly product.

These results should encourage firms that worry that green packaging is expensive, and consumers may not be willing to bear any cost. We find this perception is false. Large firms with economies of scale will be able to produce eco-friendly packaged products for the additional plastic premium, which consumers are willing to bear.

Packaging and Profits

To address the packaging issue while maintaining profit margins and product quality without compromising the product’s aesthetic appeal, manufacturers are innovating and testing several approaches. They are turning to alternative materials, including glass, bamboo and bioplastics made from sugarcane. A few companies have opted to use glass. However, since glass is heavier to transport, leading to high freight costs, many companies are reluctant to use glass as the packaging material. Some companies are considering moving towards square over round bottles since the shape allows for more efficient packing for transportation.

Firms with green offerings which consider that eco-friendly positioning compromises their existing value positioning should reconsider their stand. For example, Lush cosmetics’ option of buying package-free offerings in their retail stores or MAC cosmetics’ programme that allows customers to trade in six of their beauty containers for a free lipstick should be widely encouraged and adopted. We believe that firms with a green marketing approach that focuses on improving awareness about the importance of sustainability in cosmetic products will enhance their market share.

At present, all the existing green offerings are targeted only at the premium segment, and to make an impactful difference, this needs to become an industry-wide practice. Firms are taking small steps in that direction, but a more proactive push in that direction will lead to more customers being interested in their offerings. Firms offering eco-friendly packaged products at a small premium to offset their eco-friendly packaging practices and adopting green marketing may attract more consumers to their firm. It is a win-win strategy for everyone — firms, customers, and the environment.

Emasculating Environment

- Personal care and beauty products make up one-third of the materials found in landfills

- Beauty industry creates an estimated 120 billion packaging units per year, which make their way to landfills

- Brands with larger market share have poor sustainability practices

- Though the government has pledged to ban single-use plastics by 2022, the pressure is mostly on FMCG companies rather than cosmetics companies

Win-Win Window

- Awareness about the necessity of eco-friendly cosmetic products is very low

- All existing green offerings are targeted only at premium segment

- There is a market gap of low-priced, green products where firms could enter

- Firms offering eco-friendly packaged products at a small premium may attract more consumers

- Well-educated price-sensitive millennials willing to pay on average of up to Rs 30 more for an eco-friendly product

(Vaddi Veda Vyshnavi and Vankodoth Avinash are MBA students and Akshaya Vijayalakshmi is Assistant Professor (Marketing) at the Indian Institute of Management (IIM) Ahmedabad)

Now you can get handpicked stories from Telangana Today on Telegram everyday. Click the link to subscribe.

Click to follow Telangana Today Facebook page and Twitter .

Related News

-

Hyderabad: Residents oppose Gandhi Sarovar Project over ‘forcible’ land acquisition

-

Telangana High Court allows State, Centre three weeks to file counters on plea against GHMC split

-

Disqualification of BRS turncoat MLAs inevitable, elections soon, says KP Vivekanand

-

KTR writes open letter to CM, demands budget allocations for six guarantees

-

Iran holds military drills with Russia as US carrier moves closer

22 mins ago -

This is taxpayers’ money: Supreme Court raps freebies culture

57 mins ago -

Australia level series as Indian women slide to 19-run defeat in second T20I

1 hour ago -

Karnataka beat Uttarakhand in semis, to face Jammu and Kashmir in Ranji final

1 hour ago -

Five Osmania varsity players in South Zone squad for Vizzy Trophy

2 hours ago -

Disciplined West Indies bundle out Italy with ease, tops Group C in T20 WC

2 hours ago -

Zimbabwe shock Sri Lanka to enter super eights, African team’s sublime run continues

2 hours ago -

ACB finds irregularities during surprise check at Dundigal municipal office

2 hours ago