Hyderabad office leasing jumps 640% quarter-on-quarter

Knight Frank in its latest report showed that the share of Banking, Financial Services and Insurance (BFSI) sector in total transactions went up from 4 per cent in H2 2019 to 30 per cent in H2 2020

Updated On - 6 January 2021, 11:57 PM

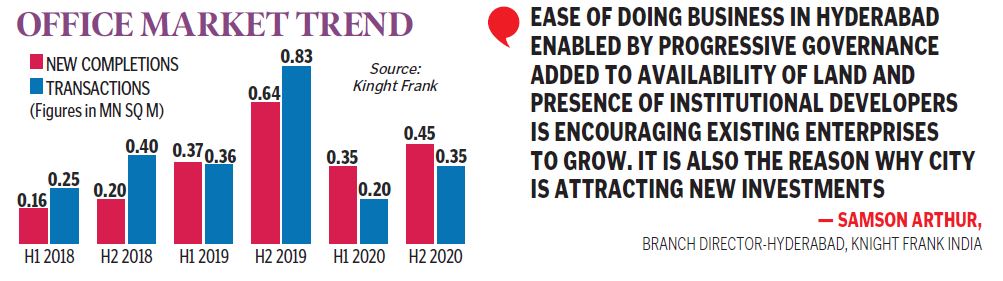

Hyderabad: Hyderabad’s office leasing activity recorded 0.4 million sq m (3.8 mn sq ft) of transacted space in H2 2020 whereas new completions stood at 0.4 million sq m (4.9 mn sq ft) during the same period. In Q4 2020, office space transactions grew by a substantial 640 per cent compared to Q3 2020.

With news of the vaccine coming in, companies have started securing their office space by implementing their lease plans. With increased business activity visible from Q3 2020 and the year-end closing have together contributed to the surge in Q4 2020 transactions volume.

Knight Frank in its latest report showed that the share of Banking, Financial Services and Insurance (BFSI) sector in total transactions went up from 4 per cent in H2 2019 to 30 per cent in H2 2020, recording a significant 248 per cent YoY growth in the sector’s office space absorption in H2 2020. This increase is a result of two large BFSI deals that together accounted for 0.1 mn sq m (1 mn sq ft) of the total leasing activity in H2 2020.

Despite the supply challenges owing to the Covid-induced lockdowns and exodus of labour in Q2 and Q3 2020, across Indian markets, Hyderabad’s office market recorded second highest annual supply numbers in 2020. About 0.8 mn sq m (8.7 mn sq ft) of new office space entered the market in 2020, which is much higher than the decadal average of 0.4 mn sq m (4.6 mn sq ft) for a year.

Pre-commitments accounted for 21 per cent, i.e. 0.1 mn sq m (1.3 mn sq ft) of the total transactions volume in 2020. In 2020, the city’s weighted average transacted rentals stabilised at 2019 levels with a near 0 per cent YoY growth in annual rents.

The average deal size increased from 7,403 sq m (79,865 sq ft) to 9,063 sq m (97,554 sq ft) in H2 2020. Large transactions (50,000 sq ft or 4,654 sq m and above) accounted for 45 per cent of the total number of H2 2020 transactions causing the jump, indicating an increase in the average floorplate requirement of occupiers.

Micro-market performance

Suburban Business District (SBD) with its Hyderabad Information Technology and Engineering Consultancy (HITEC) City and the Hyderabad Knowledge City at Raidurg, continued its dominance with a sizeable 83 per cent demand share, the highest, in the total H2 2020 transactions pie. The second-highest share, i.e. 16 per cent was accounted for by the Peripheral Business District (PBD)-West at Gachibowli.

West Hyderabad alone accounted for 99 per cent of the total H2 2020 transactions volume, which is indicative of the strong occupier preference for this location in the city. The Telangana government’s Growth in Dispersion (GRID) policy aims to diversify occupier interest across the city zones to maintain a developmental balance.

Samson Arthur, Branch Director-Hyderabad, Knight Frank India said, “Hyderabad office market saw a significant revival in Q4 2020. Despite pandemic impact, rentals remained resilient and office demand is now seeing a recalibration of size and design. With news of vaccine coming in, global companies have commenced execution of their lease plans. Managed-office operators are bridging the gap between developers and occupiers by offering bundled services which is likely to stimulate the office story further.”

He further added, “The office segment got a booster with Goldman Sachs announcing its Hyderabad entry during Covid. With the presence of Amazon’s Data Centre, inquiries in this segment also have increased. Going forward, new sectors such as the automotive and electric vehicles segments show great promise. Ease of doing business in Hyderabad enabled by progressive governance add.

Now you can get handpicked stories from Telangana Today on Telegram everyday. Click the link to subscribe.

Click to follow Telangana Today Facebook page and Twitter .