Opinion: Telangana on firm financial footing

The State has kept the Budget balanced maintaining the deficit regulations positive despite less Central transfers

Telangana has emerged as one of the 10 States in the country with revenue surplus in the first six years of its formation through its prudential budget management. In the 7th year, as the coronavirus led to an unexpected fall in the revenue, it registered a small revenue deficit. Its fiscal deficit and outstanding liabilities are also within the stipulated limits. Its GSDP per capita for 2019-20 was at 6th rank, which used to be around 18 for united Andhra Pradesh before 2013-14.

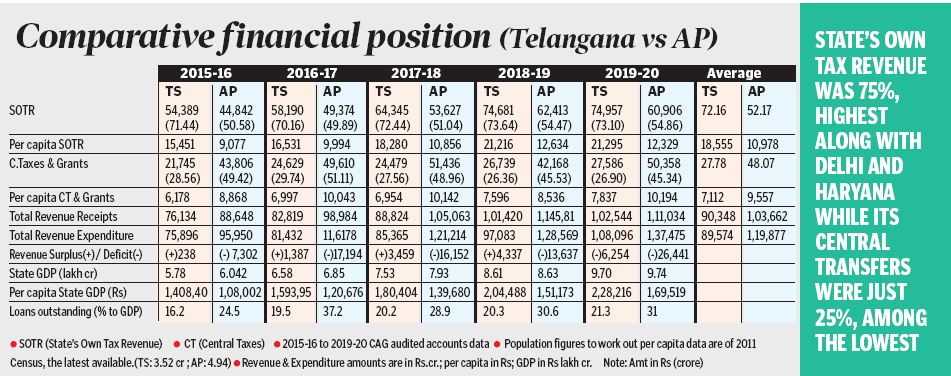

A comparative financial statement of the residual AP and new Telangana (see infographics) portrays the budgetary management of Telangana from 2015-16 to 2019-20, being the full-fledged Budgets for the divided States, with their audited account numbers.

State of Finances

The performance of Telangana as delineated in ‘The state of state finances: 2020-21’ — a study by the RBI from 2015 to 2021, is summarised as under.

Revenue receipts of States comprise revenue from own sources and transfers from the Centre. During the 2015-21 period, on average 54% of revenue receipts of States came from own sources, and 46% from Central transfers. The State’s Own Tax Revenue (SOTR) of Telangana was 75%, the highest along with Delhi and Haryana. Its Central transfers were just 25%, among the lowest as against the national average of 46%.

Own tax-GDP ratio is a measure of a State’s potential to generate taxes from its economy on its own. A higher ratio indicates a better ability to harvest taxes from the economic activities in the State. The average own tax-GSDP ratio of the States during the period stood at 6.3%. For most States, it ranged between 5% and 7.4%. For Telangana, it was 7.4%, the highest in the country.

Grants-in-aid are one of the four broad categories of revenue receipts. A higher shortfall is seen in grants-in-aid from the Centre to some States in the said period. Telangana had the third lowest Central transfers after Delhi and Haryana among the 28 States. It was also a recipient of much lower Central tax devolution than it collects for the Centre. It is a handicap to the State in spite of its better budget management.

Expenditure

Committed expenditure of a State typically includes expenditure on payment of salaries, pensions and interest payments. A larger proportion of the State Budget allocated for committed expenditure crowds out other developmental expenditures. Telangana’s committed expenditure is 42% only, as against all India average of 50%.

Expenditure on economic sectors comprises spending towards agriculture, irrigation, urban and rural development, housing, energy, and construction of roads and bridges. Between 2015-16 and 2020-21, States on average spent 31% of their budget on these economic sectors. Chhattisgarh spent the highest (44%) followed by Madhya Pradesh (39%) and Telangana (38%).

The 14th Finance Commission reiterated the recommendation that the States should eliminate their revenue deficit by 2019-20. To do so, it also provided revenue deficit grants to some. However, despite receiving such revenue deficit grants, some States, including Andhra Pradesh, Kerala and West Bengal, continued to have a revenue deficit during the 2015-21 period. Telangana did not have a revenue deficit from 2015-16 to 2018-19. Only in 2019-20, it registered a .65% revenue deficit. The average fiscal deficit of the States was 2.8% from 2015 to 2021. Telangana maintained a fiscal deficit of 2.9% during the period.

Debt Servicing

Governments are required to service the debt by making periodic interest payments as well as repaying the principal amount on maturity of the debt. Higher debt servicing costs constrain spending on other priorities. Between 2015-16 and 2020-21, the States spent 23.4% of their revenue receipts on debt servicing. Punjab used the highest proportion of its revenue receipts (84%). Telangana spent 26%.

In 2017, the FRBM Review Committee recommended that a debt to GDP ratio should be targeted for the entire country, with a 20% limit for the States. In 2020-21, 26 States estimated their outstanding liabilities to be greater than 20% of the GSDP. Outstanding liabilities refer to the debt accumulated by the States from the borrowings in the past. Higher outstanding liabilities indicate a higher obligation for the States to repay loans in the coming years. Typically, these limits are set at 25% of the GSDP in a year. At the end of 2020-21, outstanding liabilities of the State governments were estimated at 26.6%. For Telangana, this stood at 22%.

Spending

Agriculture and allied activities: It includes expenditure on subsidies, agricultural marketing, crop husbandry, horticulture, waiver of agricultural loans (in some States) and implementing schemes, including Prime Minister Faisal Bima Yojana and Rashtriya Krishi Vikas Yojana. The States on average spent 6.4% of their Budget on agriculture. Telangana spent 11.3%, highest after Punjab.

Energy: Expenditure under this includes subsidy to consumers, allocation for power projects and assistance to discoms under the UDAY scheme in certain States. The States on average spent 5.7% of their Budget on the energy sector. Telangana spent 7.3%. From facing extreme power shortage in 2014, Telangana has now become power surplus.

Social security: The States on average spent 4.1% of the Budget on social security. This consists of 0.1% of the Budget on capital outlay and 4% on revenue expenditure. Telangana spent the highest at 6.9%.

Irrigation and flood control: The States on average spent 4% of their Budget on irrigation and flood control. This consists of 3% on capital outlay, and 1% on revenue expenditure. Telangana again spent the highest at 8.4%.

Welfare of SC, ST, OBC: States on average spent 2.9% while Telangana spent 6.9 %, second highest among the States.

Housing: It was 1.3% on average for the States while Telangana spent 1.8% of the Budget.

JR Janumpalli

There are a few sectors on which Telangana spent less than the average of States in view of the prioritisation needs and the budgetary limitations. But in most areas, its spending was above average and high-end. At the same time, the State kept the Budget balanced maintaining the deficit regulations positive. It is quite a creditable prudential financial management for a new State with less Central transfers and in need of finding its moorings to settle down.

(The author is a freelance journalist)

Now you can get handpicked stories from Telangana Today on Telegram everyday. Click the link to subscribe.

Click to follow Telangana Today Facebook page and Twitter .

- Tags

- Delhi

- flood control

- FRBM

- GSDP

Related News

-

Opinion: Time to ban paraquat — the poison without an antidote

2 hours ago -

SJFI national convention returns to Delhi with Hero MotoCorp as title sponsor

2 hours ago -

Delhi beats Hyderabad by nine wickets in BCCI women’s under-23 one-day championship

2 hours ago -

Hyderabad player Sowmith Reddy wins Unrated Chess Tournament at A2H Chess Academy

2 hours ago -

Editorial: T20 World Cup glory— rise of the Blue Tide

2 hours ago -

HC clears Ram Rahim in murder case, says CBI acted under pressure

2 hours ago -

Nampally court dismisses Sakala Janula Samme case against KCR, KTR

3 hours ago -

Bhoodan land row: 43 booked for violent protests in Khammam

3 hours ago