You can reduce your home loan and pay lower EMIs

Get in touch with the current lenders or different lenders for home refinancing

Updated On - 9 July 2021, 06:34 PM

Hyderabad: Interest rates at the start of September 2019 were around 8.4%. As of July 2021, at least 20 banks are offering homes loans below 7 per cent as fresh loans as well as balance transfers.

The bank rates are falling because RBI has slashed the repo rates from 6.5 per cent in 2018 to 4 per cent in 2020. As a result, home loans benchmarked to the repo rate became cheaper.

What can homeowners do

New home loan borrowers can automatically avail loans at low rates prevailing now. Borrowers, who have taken home loans before October 2019, may be paying higher rates. This increases the overall cost of borrowing. However, opting for refinancing – paying off existing home loan by taking off a new home loan with better terms- can result in lower interest payments, smaller EMIs, and shorter loan tenures. The new loan can be taken either with the same lender or a new lender.

Timing of refinancing

Refinancing early in your loan tenure – typically in the first half – makes sense as during this time EMIs focus mostly on recovering interest. Therefore, a refinanced loan at a lower interest rate will lead to savings in the interest outgo. A loan cheaper by around 50 basis points (0.5 per cent) or more could lead to a shorter loan tenure, lower EMIs, lower interest payments, and large long-term savings. One should opt for refinancing when the projected savings exceed the costs. A cheaper loan will also help improve the rental yield from your under-loan property.

Savings

For example, a loan of Rs 50 lakh at 8% interest for 20 years attracts an interest of Rs 50.37 lakh. If this loan is refinanced at 7.00%, the interest falls to Rs 43.03 lakh, ensuring savings of nearly Rs 7 lakh, whcih can be used for savings, investments, travel, vehicle upgrade or higher education, according to Adhil Shetty, Chief Executive Officer, BankBazaar.com.

Different scenarios

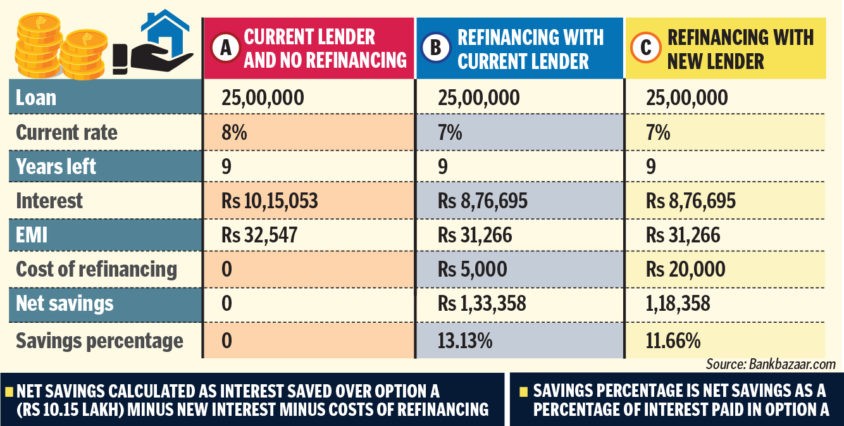

For instance, a loan balance is Rs 25 lakh at 8% with nine years left.

Here are the possible options:

1) Do nothing, remain with the current lender. In this case, there will be no change in the EMIs, interest, tenure.

2) Seek refinancing to a lower rate with the current lender. In this case, the refinancing costs will be lower. There will be a small procession fee and minimal paperwork. There will be no further inquiry into the credit history or income.

3) Seek refinancing to a lower rate at a new lender. This is taking the loan afresh and will call for scrutiny of credit history, credit score. It could have a relatively higher processing fee. But the savings will be higher.

Now you can get handpicked stories from Telangana Today on Telegram everyday. Click the link to subscribe.

Click to follow Telangana Today Facebook page and Twitter .