Centre ‘choking’ Telangana financially

Hyderabad: Telangana’s impressive march on the growth path could face speed-breakers if the BJP government at the Centre has its way in turning down the State’s repeated pleas to allow it to raise funds through Open Market Borrowings (OMBs). The Centre has, so far, held back giving its nod to Telangana to take the OMB […]

Hyderabad: Telangana’s impressive march on the growth path could face speed-breakers if the BJP government at the Centre has its way in turning down the State’s repeated pleas to allow it to raise funds through Open Market Borrowings (OMBs). The Centre has, so far, held back giving its nod to Telangana to take the OMB route on flimsy grounds such as off-budget borrowings and guarantees to various corporations.

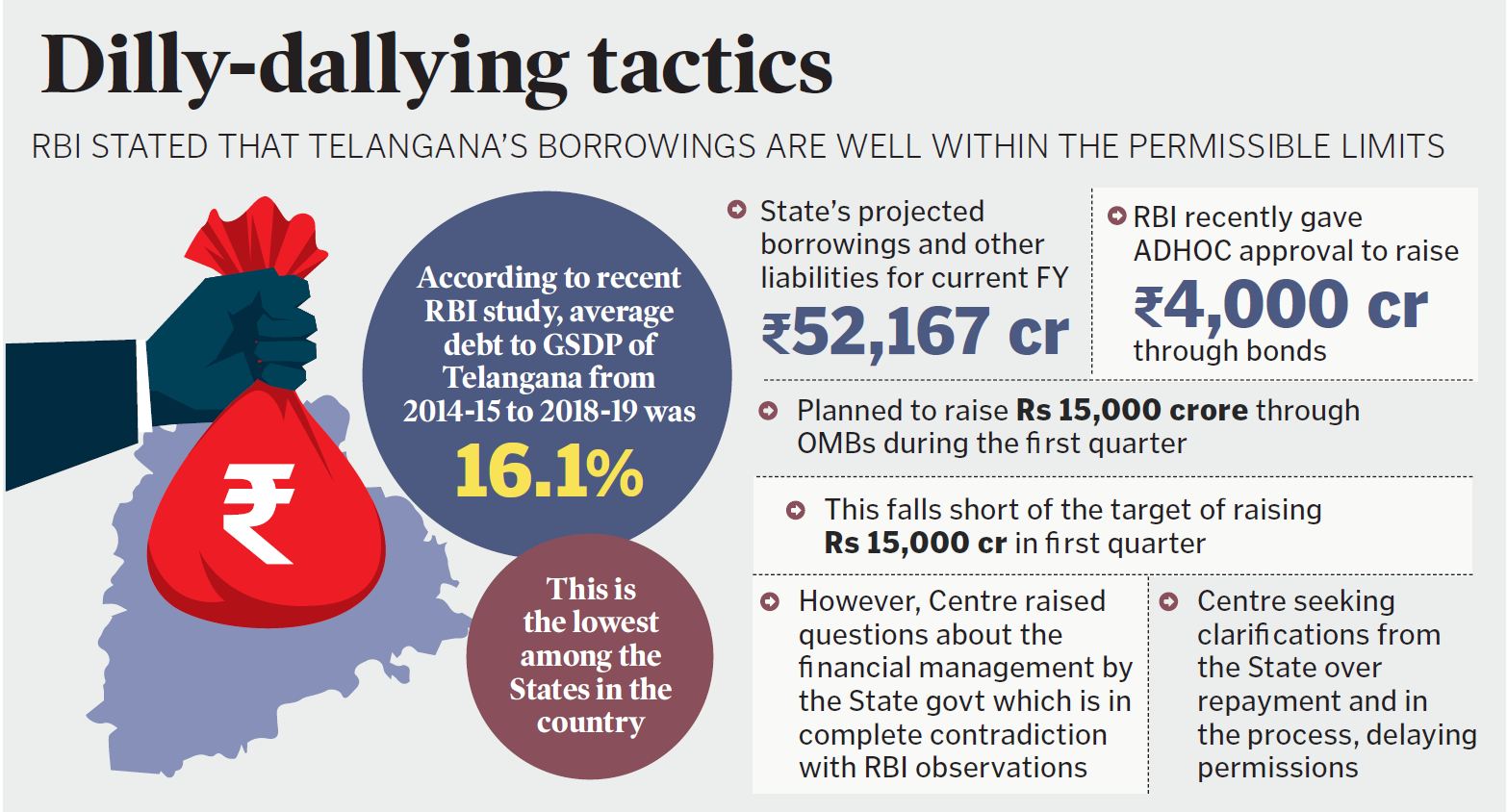

The Centre’s delaying tactics appear to be deliberate, and part of its design to choke Telangana financially, given the fact that the Reserve Bank of India (RBI) itself has categorically stated that the State’s borrowings are well within the permissible limits. According to a recent RBI study, the average debt to Gross State Domestic Product (GSDP) of Telangana from 2014-15 to 2018-19 was 16.1 per cent, which is the lowest among the States in the country.

The BJP government, however, has been raising questions about the financial management by the State government that seems to be in complete contradiction with the RBI observations, leading to suspicion that it was a deliberate attempt to stall the growth of a progressive State like Telangana.

The State had projected borrowings and other liabilities at Rs 52,167 crore during the current financial year, and had subsequently planned to raise Rs 15,000 crore through OMBs during the first quarter (April-June). Its efforts, however, have so far not materialised due to the inexplicable delays on the part of the Centre in giving its nod. Though the Reserve Bank of India recently gave adhoc approval to raise Rs 4,000 crore through bonds, this falls short of the target of raising Rs 15,000 crore in the first quarter.

Telangana provided bank guarantees to GHMC, Telangana State Civil Supplies Corporation and the Irrigation Development Corporation, among others. The majority of the funding has been raised through off-budget borrowings and the State government is repaying them and will continue to do so till projects like Kaleshwaram become financially sustainable.

Several States avail the OMBs to overcome the shortfall in finances and to meet their immediate financial needs. But they have to obtain the Central government’s approval under the provisions of Article 293 of the Constitution. Though the grant of permission is by and large a routine affair, the Centre has raised certain queries on the financial health of the State reportedly based on the off-budget borrowings and guarantees given to various corporations. The Central government has been seeking clarifications from the State over repayment and in the process, delaying permissions.

State governments are allowed to issue guarantees for borrowings by State Public Sector Enterprises (SPSEs) from financial institutions which together should be around three per cent of the State’s GSDP. Sources said that this too was well within the permissible limits in Telangana.

The outstanding liabilities as a proportion of GSDP in the case of Telangana were just 24.84 per cent in 2021-22. This is much lower when compared to neighbouring States like Andhra Pradesh (36.5 per cent) and Karnataka (26.9 per cent) as well as BJP or its coalition-ruled States like Himachal Pradesh (40.26 per cent), Bihar (32.3 per cent), Madhya Pradesh (28.5 per cent) and Uttar Pradesh 28.1 (per cent) which were all permitted to raise OBMs.

Officials in the Finance Department said the government could raise the resources required as the Fiscal Responsibility and Budget Management (FRBM) limit fixed by the Central government allowing States to borrow 3.5 per cent of their GSDP was continuing during the current fiscal. But with uncertainty looming large over the quantum of OMBs that the State can raise during the current fiscal amid the Centre’s delay in approvals, the State government is also planning to explore all other options to raise funds.

Related News

-

Disqualification of BRS turncoat MLAs inevitable, elections soon, says KP Vivekanand

-

Hyderabad: EAGLE Force arrests man with 28 kg ganja at Abdullapurmet

-

BRS Impact: TSHRC orders immediate restoration of water, power, for Dalits in Hanamkonda

-

GHMC conducts intensive early-morning inspections across multiple zones

-

Two Belgian Malinois sniffer dogs inducted into Kothagudem district police force

13 mins ago -

Casagrand Introduces Hyderabad’s First UPARTMENT with the launch of Casagrand Mandarin in Miyapur

17 mins ago -

Cheques distributed to women at Nava Women Empowerment Centre

27 mins ago -

Jagan alleges irregularities in Tirupati laddu ghee supply during Chandrababu Naidu’s tenure

30 mins ago -

15-month-old boy etches his name on international record book in Nirmal

39 mins ago -

Gold ornaments stolen from woman at Jogipet bus station

44 mins ago -

KTR writes open letter to CM, demands budget allocations for six guarantees

49 mins ago -

Auto drivers and unions join BRS signature campaign for SCB merger in Secunderabad Cantonment

52 mins ago