Rewind: Too taxing an idea

The proposal of doubling farmers’ income and the idea of taxing farmers’ income counter each other.

By E Revathi, A Venkateshwarlu

Hyderabad: In recent times there has been discussion on the idea of levying income tax on farmers’ income. Bibek Debroy, Chairman of the Economic Advisory Council to the Prime Minister, raised the issue in an article in The New Indian Express on January 21 titled ‘The Necessity of Taxing Farmers’ Income in India’.

Given the existing conditions of the economy, when the contribution of agriculture in terms of share of total gross value added (GVA) is as low as 15%, and around 46% of the workforce is engaged in the sector, this is unreasonable. Debroy quoted Wilson, who was influenced by England’s agricultural system, where actual cultivators were capitalist tenant farmers, leasing land from the landlords. The capitalist farmers used to pay taxes to the government and also rent to the landlord (Marx, Vol III).

Similarly, the British East India Company imposed a landlord system in India through permanent settlement in Eastern India. It is contextual to discuss the KN Raj Committee on taxation of agricultural income firstly, and then the rationality in the proposition of levying ‘agricultural income tax’ on farmers.

KN Raj Committee

In February 1972, the Committee on Taxation of Agricultural Wealth and Income was set up under the chairmanship of Prof KN Raj. The economic situation then was quite different in a few ways:

. Direct taxes contributed just over 20% to the total tax revenue, and as a consequence, the dependence on indirect taxes (ie, taxes on commodities and services) was to the extent of around 80%

. India’s economy was dependent on agriculture, which contributed over 60% to the total GVA, ie, to India’s GDP

. Two wars (with China in 1962 and with Pakistan in 1965), and the death of two Prime Ministers in 1964 and 1966, led to a Plan holiday for the Fourth Five Year Plan, and in their place, three Annual Plans (1966-67, 1967-68 and 1968-69) came up. Further, the land ceilings implemented in the mid-60s became a farce, which caused rural turmoil against large landowners/landlords culminating in the Naxalite movement (May 1967). The big landowning classes dominated the legislative Assemblies and Parliament; and thus, ceilings on land ownership were a futile exercise. In addition to this, by 1972-73, the terms of trade were in favour of agriculture by 50% against the non-farm sector (Ashok Mitra, 1979).

. Indira Gandhi, who became Prime Minister on January 24, 1966, had to agree to devalue the rupee by more than 30% in 1966, and adopt import liberalisation so that exports in the industrial sector would end industrial stagnation (Raj, 1976). The proposal by the United States Agency for International Development (USAID) was already conveyed in October 1965 in her predecessor’s government. Further, USAID imposed a condition to devalue the rupee for exporting chemical fertilizers from the US (Raj, 1966).

Rising Direct Taxes

The Raj Committee report considered the fact that the bulk of the additions to tax revenue in India during the 1950s and 1960s had come from indirect taxation, and indirect taxes would continue to have an important role in the fiscal system.

But the situation has changed over the period. The share of direct taxes which was 22.75% in 1974-75, gradually went up. From one-fifth, it rose to over two-fifths by the time the UPA government came to power. The UPA regime, under the influence of supply-side economics, guided by the economist Arthur Laffer’s argument that reduction in tax rates increases tax revenue, reduced the number of slabs along with reduced rates in direct taxes. Such reduction brought good results too. The percentage share of direct taxes in total tax revenue increased from 42.7 in 2004-05, reaching a peak of 56 in 2008-09. It was 55.4 in 2014-15. Thereafter, it went on sliding from 47.6% in 2015-16, reached a peak of 54.9% in 2018-19, and settled at 47.5% in 2022-23.

Share in GVA Smaller

The Raj Commission also noted that though the need for taxation of agriculture was necessary for a country like India which was mostly agricultural in character; the form and incidence of such taxation would depend on the political structure and the objectives of economic policy, as KN Raj said in his Ramaswami Memorial Lecture, delivered on March 12, 1973.

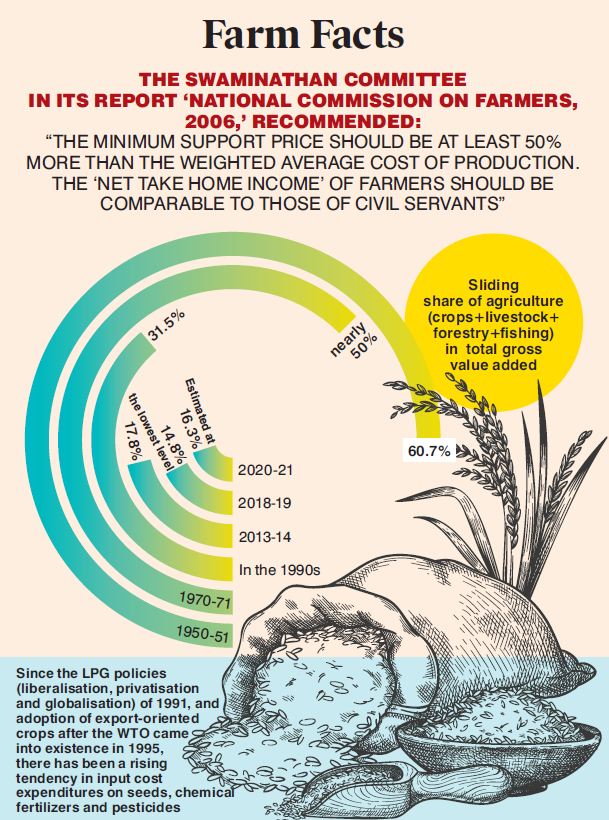

But now the situation is different. In 2011-12 constant prices, the share of agriculture (crops+livestock+forestry+fishing) was as high as 60.7% in the total GVA in 1950-51. It was at its lowest level of 14.8% in 2018-19, and is estimated to stay at 16.3% in 2020-21. (see infographics). During the pandemic, when all sectors turned negative, only agriculture performed well with around 3.5% growth rate. Overall, for the 71 years period from 1950-51 to 2020-21, agricultural GVA grew at 2.71%, while the total GVA grew at 4.91%.

Cost and Climate

There has been a rising tendency in input cost expenditures on seeds, chemical fertilizers and pesticides since liberalisation, privatisation and globalisation (LPG) policies of 1991 on the one hand, and adoption of export-oriented crops after the WTO came into existence in 1995, on the other.

Further, climate change too is having a tremendous adverse impact on Indian agriculture with the occurrence of more untimely cyclones and depressions, causing heavy rains, and floods, along with long, dry spells and drought situations leading to crop failures and losses, and suicides. The National Crime Records Bureau recorded that 3,61,970 farmers’ suicides occurred during 1995-2021.

Michael Shafi reported in The Guardian, on July 31, 2017, that in India, climate change also might have contributed to the suicides of nearly 60,000 Indian farmers and farm workers over the past three decades.

Swaminathan Commission

The most important problem is that the farmer cannot fix the price of the agricultural produce just as any other commodity producer or service provider. Hence, the demand for mandatory MSP. The Swaminathan Committee in its report National Commission on Farmers, 2006 recommended: “The Minimum Support Price (MSP) should be at least 50% more than the weighted average cost of production. The ‘net take home income’ of farmers should be comparable to those of civil servants”.

Land Holdings and Tax

The second phase of land ceilings of the mid-70s and the population growth led to the fragmentation of land holdings. In 2012-13, as per NSS report No. 571, households that own land >= 4 ha stood at 3.386 million and they own 22.760 million hectares, which works out to be an average land of 6.721 ha per household. If we go by household operational holdings, which was preferred by KN Raj (1972 and 1973) for Agricultural Holdings Tax: in 2012-13, there were 3.710 million households operating 23.951 million hectares — average land of 6.457 ha per household.

In 2012-13, 7.41% of rural households did not own any land, 75.41% households owned 29.75% of land, in the size class of 0.002-1.000 ha, with average land of 0.234 ha/household. Similarly, in respect of household operational holdings, 73.17% households operated 27.71% of land, in the size class of 0.002-1.000 ha, with average land of 0.329 ha/household. Further, in the total rural households, neither owning nor operating households accounted for 5.95%, while those owning but not operating land stood at 24.36%. Thus, 30.31% of rural households in total were not operating land in 2012-13.

Assessing Agri Income Tax

Administrative difficulties arise in assessing agricultural income tax with regard to two important issues: the first relates to taking a farmer as a unit or his family as a unit, and the second relates to the size of the farm and its potential/real productivity.

With regard to the first issue, the Raj Commission adopted the nuclear family as a unit: “For purposes of direct taxation, it is our view that the nuclear family — consisting of husband, wife and minor children — is the appropriate basic unit for assessment. … For administrative reasons also the family has to be made the basic unit for assessment of direct taxes if large-scale evasion through splitting of incomes between family members is to be avoided”.

Addressing the second issue, the Raj commission’s suggestions were:

. Operational holdings and potential productivity have to be chosen for the assessment of income tax. The determination of potential productivity is very difficult, because of the different properties of soil, availability of water and climatic conditions

. It is obvious that the objective conditions that have to be taken into account in assessing potential productivity may differ to such an extent that the methods suggested in one set of circumstances may not seem appropriate or reasonable in another situation. Any scheme of taxation of this kind, therefore, has to have within it sufficient flexibility to be adapted to the requirements of each case.

. As regards the size, there is no specific size or cut-off point for choosing the farm size, the Commission had given some methods. But in the present condition, nearly 75-80% of operational holdings are below 1 hectare (2.5 acre nearly). Around 86% of holdings are those of small and marginal farmers operating below 2 hectares. Moreover, the tenancy is unreported and tenancy is not assured. Tenancy laws act as a deterrent to marginal and small land owners to give written agreements for the fear of conferment of rights to the tenants.

The government of India appointed a committee on tenancy headed by T Haque, and the Report of the Expert Committee on Land Leasing (2016) prepared a Model Act of Tenancy. As per its provisions, a lease agreement may be either registered under the Registration Act or attested by the village revenue officer or sarpanch or a notary, but it shall not create or confer any right over the land on the lessee cultivator. Such protection to land owners may encourage open tenancy.

Way back, KN Raj also considered various administrative problems that might be difficult to overcome in practice to organise and operate effectively the agricultural holdings tax. The problems faced include: non-availability of records relating to operational holdings, difficulties in demarcating tracts and areas that are broadly homogeneous with respect to soil and climate, burden that would be imposed on the administrative machinery if the assessments have to be made annually, and difficulties posed by the existence of ‘benami’ holdings.

The government of India had proposed to double farmers’ income by 2022 but we are yet to realise it. Proposals such as tax on “farmers’ income” seem to be countering the government’s intention and is certainly a regressive idea in the current context.

(E Revathi is Professor and Director, Centre for Economic and Social Studies [CESS]. A Venkateshwarlu is consultant with CESS)

- Tags

- agriculture

- Farmers

- India

- taxes

Related News

-

Fertilizer booking app fails to end farmers’ urea troubles in Karimnagar

-

India beats France 21-14 to win HPRC International Arena Polo title

-

India AI Impact Summit 2026 draws strong global response, 70 teams named finalists

-

From India to the World: AI Mahashivaratri by SUPER AI Academy Unites 500+ Participants to Create 5,700 Telugu Devotional Songs

-

Praful Patel backs demand for CBI probe into Ajit Pawar plane crash

8 mins ago -

Editorial: India-France tango uplifts the mood

34 mins ago -

D K Shivakumar tells Karnataka contractors govt will pay as per budget

50 mins ago -

Opinion: MLA is not a Public Servant — justice lost in interpretation

1 hour ago -

Is it a crime to win majority of wards, Suman asks Vivek before arrest

1 hour ago -

Deer killed in road accident in Kothagudem

2 hours ago -

Speaker concludes hearing on disqualification petition against Danam Nagender

2 hours ago -

Consumers’ body wants BIS Standards Clubs set up in schools, colleges in Telangana

2 hours ago